A GLOBAL COMMERCIAL LEASE FOR THE NEW CENTURYSimon ADCOCK, AustraliaKey words:

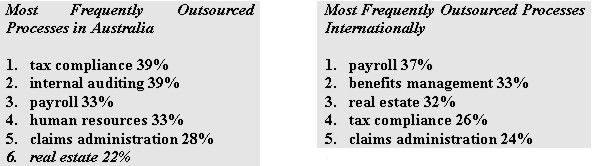

BACKGROUNDOperating successfully in a global economy, western world governments and private business have now developed distinctions between managing the delivery of services and undertaking those services. Global organisations are beginning to institutionalise or standardise practices across their worldwide operations. This provides them with greater efficiencies through the implementation of consistent business processes that leads to best practice; higher quality services and ultimately lower service costs through economies of scale. A major opportunity to drive this process would be achieved by the development of a Global Commercial Lease. Recognising that we are still a long way from a worldwide property market with like conditions, in fact in Australia where I come from we have markets within regional markets and I am sure that this true for most of you here. Such a lease document could, for instance, contain clauses that are "mandatory" and are "guidelines". This would streamline the process, facilitate best practice and enhance management practices for an organisation's business operations. Indeed, organisations who have already adopted this practice at the micro or local/regional level can testify to its benefits. Such a document would, of course, need to be judged by professionals as a document that is balanced, fair, of quality and quantifiable. This paper/workshop will firstly examine the background and fundamental purpose of commercial leases; it will identify the key elements of a lease and extrapolate its effects on capital value which, say, a Global Pension Fund could rely upon. The State Government of Victoria's standard lease, a modern-commercial lease developed over several years of experience and refinement, will be the catalyst for these discussions. The experience of Valuer General Victoria (where I work) provides a case study that relates the importance of commercial leases on both operations and the capital value of commercial premises. This is a paper that explores the advantages of standardising lease documents from a local to a global level in the context of the impact on business practices. PART 1 - HISTORY OF COMMERCIAL LEASESIn the ruins of ancient Pompeii there is much evidence of shops, including roadside take-aways. I suggest that the concept of commercial leases began during (or even before) ancient Chinese times - perhaps it was this somewhat advanced mercantile development and the establishment of retail stores by merchants combined with the Chinese acute sense of business that got it all going. All we know is that there seems to have always been differences of opinion between tenants and landlords over lease terms and the level of rental which should be paid. Leases have developed from probably what were simple agreements to what is now often seen as complex and difficult documentation developed by the legal fraternity. Many would argue that this has served to make life more difficult for the parties involved rather than simpler - particularly the valuer or appraiser who undertakes an assessment during a rental dispute. Supply of and demand for commercial premises has often dictated the level of bargaining which each party has entered into during the phase of lease negotiations. Through the centuries such disputes have caused a rift between the parties. However, the modern commercial lease fundamentally aims to bring a level of certainty and to reduce the risk factors associated with landlord and tenant perceptions in relation to reality. A quality lease document can therefore greatly enhance certainty for both investors in terms of returns and for tenants in terms of tenure and budget. In addition, because both parties understand precisely where they stand, synergies and good business relations can be created in the business community. PART 2 - GLOBALISATION OF UNDERTAKING SERVICESThe development and growth of international global pension funds, multi-national companies, property outsourcing service providers, in addition to advancements in technology are impacting dramatically on day-to-day business activities. Globalisation has developed to a level where the development of a global commercial lease is inevitable and in fact desirable in order for the real estate market to continue to attract capital funding. PricewaterhouseCoopers (PwC) is a leading global property outsourcing service provider who already manages the Australian government's extensive international owned real estate portfolio. This comprises embassies, Head of Mission residences, staff residences and commercial property in about 60 countries. PwC recently won the mandate to manage National Australia's Bank $US1.7 billion international real estate portfolio. This portfolio covers in excess of 2,600 properties across a number of countries. Mr Terry Weber, partner of PwC in Australia recently stated "in an increasing global economy, businesses want consistent processes, reporting and performance standards, where ever they do business, and our global reach means we can deliver that. In the UK we will mirror the service delivery standards already established for National Australia Bank in Australia, so a common global performance framework can be established."1 The National Bank recognised the benefits that standardising the management of its Australian real estate portfolio of about 1,200 properties achieved and wanted to bring the same benefits of savings and efficiencies globally. One of the key "planks" of this development would be greatly enhanced with the standardisation that would come from a Global Lease. The concept of globalisation and its importance is further emphasised by the former United States President, Bill Clinton, at an APEC meeting held in Singapore in November 2000. Mr. Clinton said "Globalisation brought great benefits to Asia and the world." He added, "it also requires strong safety nets, more quality education, anti-poverty efforts, labour and environmental standards so people believe globalisation is leading not to a race to the bottom but to a higher standard for all." 2 I am of the opinion that a Global Commercial Lease will bring higher standards and accountability for both landlord and tenant. As the business elite of the world can now easily travel across borders, switch languages and enjoy enhanced mobility and flexibility through technology, the drive to obtain profits and provide client services throughout the world can greatly accelerate. An executive research consultant in Europe recently reported that 40 of Europe's biggest 200 companies are now run by non-native Chief Executives. Globalisation is truly with us. Globalisation and the quest to sharpen one's competitive edge has lead to business process outsourcing (BPO) and in 1998, PwC sponsored a major research paper into the level of outsourcing in practice. A total of 304 companies, headquarters in 14 countries, participated in the study. These companies ranged in size from $US 1 billion to over $US 50 billion in revenues (or assets). On average each company had about $US 5 billion in revenues and 17,200 employees. Most of the companies, (78%) had significant international operations and many (63%) had outsourced one or more of their business processes. Furthermore, in the non-core functions identified in this research paper, it was established that generally companies are outsourcing those business processes that are not core to their fundamental business operations. The following tables indicate those most frequently outsourced business processes:

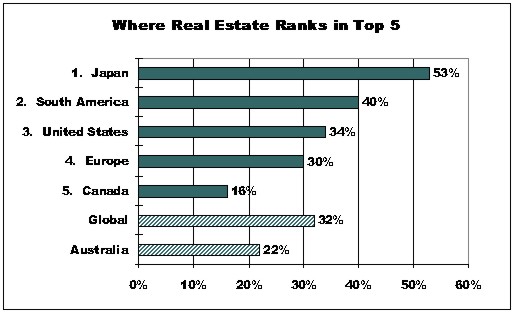

Source: Global Top Decision-Makers Study on Business Processing Outsourcing, September 1998, PricewaterhouseCoopers. At the time of the survey real estate outsourcing rated sixth in Australia as an activity most frequently outsourced - given recent developments, this trend is changing. The following graph indicates those countries where real estate outsourcing actually ranks in the top five.

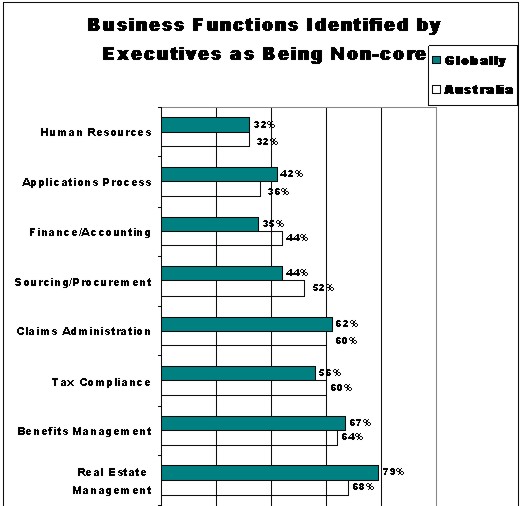

Source: Global Top Decision-Makers Study on Business Processing Outsourcing, September 1998, PricewaterhouseCoopers. Interestingly, real estate is the business function most frequently mentioned by executives as being non-core to their business operations.

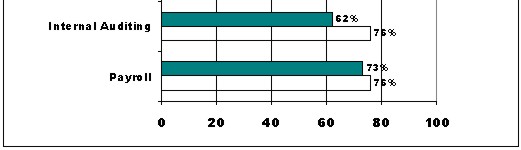

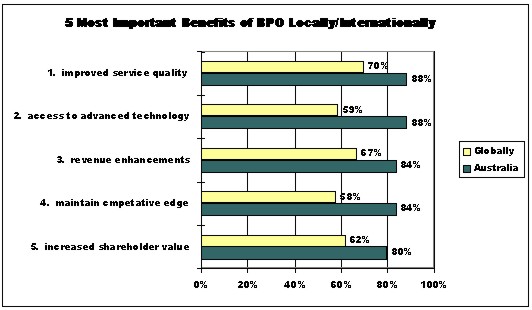

Source: Global Top Decision-Makers Study on Business Processing Outsourcing, September 1998, PricewaterhouseCoopers. Top decisions maker's worldwide see a range of strategic benefits from their BPO operations. Although ranking varies from country to country, globally, these include:

Source: Global Top Decision-Makers Study on Business Processing Outsourcing, September 1998, PricewaterhouseCoopers. In addition to improving the quality of service, these benefits translate to:

BPO would be greatly enhanced by the development of a Global Commercial Lease. It would enable an accurate understanding of the company's real costs and for true benchmarking to be undertaken - truly strategic benefits. PART 3 - INGREDIENTS OF A "GLOBAL COMMERCIAL LEASE" WHICH IS RELATED TO THE SIZE OF THE TENANCYLandlords and Tenants fundamentally want to limit the areas of risk, which lease documents often present. This level of risk can be reduced and business practices enhanced by the development of mandatory and guidelined conditions, which would form the Global Commercial Lease. Noting the idiosyncrasies, complexities and compliance with an individual country's laws is essential. Markets in Melbourne, Australia where I operate, obviously differ from London. Perhaps the philosophies are not too different but local market forces sometimes do not lend themselves to structure a lease the same way we do in Melbourne. Obviously, new and emerging markets such as Port Moresby in Papua New Guinea are different again as are other older, and culturally diverse markets in places like India and China. 3.1 Mandatory Items - in Global Commercial LeaseDespite all of these differences there are, however, several items that could form the mandatory section of a Global Commercial Lease: 3.1.1 Defined premises It is desirable for each tenant to be able to be provided with an address and the area occupied within the tenancy. International standards or methods of measurement are needed to define areas of exclusivity and areas of common use. 3.1.2 Defined term of the lease Commencement date of lease, Occupation date and option periods go without saying. 3.1.3 Rental This is by far the most contentious item and the treatment in standard leases is considerable. A level of certainty is often sought by both parties. Yet both parties like to keep in line with market movements or close to market movements in order to maintain strategic competitiveness in the return on the property and from the payment of expenses from a business activity view point. At strategic stages through a lease term, it is desirable to have "an open market review" which enables the levels of rent to be adjusted at what a willing tenant and a willing landlord would consider to be "open market level". Often this enables expert advice to be sought from Valuers and Appraisers. 3.1.4 Building Operating Costs and Expenses For major leases of significant size, it is desirable for an "independent audited statement of outgoings to be supplied to form the basis of such assessments. Furthermore, these outgoings should relate to the benefits, improvements and maintenance of the complex or demised premises and avoid non-related items as fuel paid for the landlord's yacht! In addition, state if the Landlord or tenant's responsibility for each expense. How can you benchmark anything when the information is not accurate? 3.1.5 Make good of the premises on departure In my experience every tenant makes some changes to the internal environment of the premises which has been leased. The obligations for make good need to be defined and where possible quantified in a volume of dollars. 3.1.6 Use of premises The hours of operation and type of business or trade to be undertaken needs to be reasonably defined in order that each side's expectations can be met. 3.2 Guidelines - items - in Global Commercial LeaseRequirements which relate to specific countries and other items which a specific country or market sees as desirable. 3.2.1 Compliance with Statutes The compliance with statutes in each country (in Australia this is the Labour and Industry Act) often falls to various parties of the transaction. As a guide, these should be set within the lease document and not just assumed. 3.2.2 Warranty of Fitness of building including Machinery The fitness of the building in regard to plant and machinery when it comes to a capital nature, as distinct from a repair item, depends upon the economic life of the machinery. This also often has industry standards within a particular country which could be used as a guide. 3.2.3 Dispute Settlements Each market and country has its own distinct dispute settlement arrangements including jurisdictions. PART 4 - BENEFITS AND CHALLENGES OF GLOBAL LEASE UPON BOTH COMPARISON/BENCHMARKING PURPOSES AND CAPITAL VALUE4.1 BenefitsThe major benefit from working towards a Global Commercial Lease will be derived from its capacity to provide quality data capable of being benchmarked across countries and in turn, enhance return rates on capital equity. This will be achieved by being able to consistently itemise costs of maintenance, rental payments and rates of growth as a unit rate of say, net lettable area, and quoted as a rate per square metre. Once this has been achieved costs can be managed by obtaining competitive quotations from the market place. In turn this will result in driving down the cost base through competitive tendering and the "bundling" of services. Bundling of services is a by-product of this activity and could, for example, be the supply of power across all properties in a number of countries by a single utility. 4.2 Asset SecuritisationAsset securitisation is a complex and sophisticated financial arrangement which is often backed by commercial property. Asset securitisation tends to involve a group of properties which forms the anchor of the proposed transaction and or borrowings/mortgage. A Global Commercial Lease which extends across the entire portfolio to be securitised would thus be of substantial benefit. Securitisation is still an evolving market and will provide an opportunity for further investigations. 4.3 ChallengersThe major significant impediment of a Global Commercial Lease is that many real estate markets around the world tend to operate and be dominated by local factors. Some of these are legitimate methods of operation while others are not necessarily legal (although accepted). The absence of strong commercial legal protections in some countries is also a problem. These factors create idiosyncrasies and twists that will make benchmarking and other standardisation processes difficult to implement. PART 5 - CONCLUSIONThe challenge for Global Pension Funds and Global Service Providers is to develop a document which is seen as a "win-win" document for Landlords and Tenants worldwide. It must firstly establish a consistent framework as a beginning. The State Government of Victoria's standard lease provided a catalyst in the early 1990s that as a tenant it was able to start standardising its occupancies in buildings owned by various owners. The next phase of this development requires significant larger players in the market place on a global scene. PwC, through its work with the Australian Government and the National Bank have already begun such a process on a global scale. DisclaimerI would like to draw to your attention that the views presented in this paper are my own; and should not be construed as representing those of the State Government of Victoria - Australia. REFERENCESArthur Andersen, (Winter 1999/2000), Hospitality and Leisure Executive Report, Volume 6, Number 4, Arthur Andersen. Campbell, D, (November 2000), Who ya gonna Call, Financial Review Boss, November 2000, 9, pp 32-33, Sydney, John Fairfax Publications Pty Ltd. Crompton, C, (August/September 2000), Outsourcing: Freedom or Foe, FM Magazine, Volume 8 Number 4, pp 31-40, Melbourne, Niche Media Pty Ltd. Drake, Drake Business Review, Volume 14 Number 1, Australia, D & D Printing. Garran, R., Alford, P. (16 November 2000), Singapore deal to go 'APEC-wide',

The Australian, pp. 6, Sydney. Hartcher, P. (3 November 2000), Reds and bedfellows, The Australian Financial Review, pp. 41, Melbourne. Krause, D.G., (1997), The Way of the Leader, Great Britain, Nicholas Brealey Publishing Limited. Partridge, J. (24 November 2000), Partridge: Man on a global mission, The Australian, pp. 44, Sydney. Matlack, C., Capell, K. (30 November 2000), Managers without borders, The Australian, pp. 40, Sydney. Professional Practice, (1999), Australian Property Institute API Professional Practice, 1999, pp. 11 & 243, Australia, Australian Property Institute. Proposed Applications and Performance Guidance Valuation of Lease Interests, International Valuation Standards, September 1999, pp. 1-11, Technical Director International Standards Committee, London. Real Estate Now, (1997), Pension Funds - Changing Investment Strategies, Real Estate Now, New York, PricewaterhouseCoopers. State Government Standard Lease Document, (Revised January 2000), Department of Treasury & Finance, Victoria Government, Melbourne. Stephenson, P, (November 2000), Wrong Way Go Back, Financial Review Boss, November 2000, 9, pp 27-30, Sydney, John Fairfax Publications Pty Ltd. The Modern Reference Encyclopaedia Illustrated, 1932, Great Britain. Yankelovich Partners, (September 1998), Global Top Decision-Makers Study on Business Process Outsourcing, Australia, PricewaterhouseCoopers. Yankelovich Partners, (August 1998), Global Top Decision-Makers Study on Business Process Outsourcing, pp. 5, Australia, PricewaterhouseCoopers. FOOTNOTES1 Hartcher, P. (3 November 2000), Reds and bedfellows, The Australian Financial Review, pp. 41, Melbourne 2 Garran, R., Alford, P. (16 November 2000), Singapore deal to go 'APEC-wide', The Australian, pp. 6, Sydney ACKNOWLEDGEMENTHartigan, J. Director, Land Registry, Land Victoria, Dept. DNRE BIOGRAPHICAL NOTEAs a Manager, Client Valuations for Valuer General Victoria, Simon Adcock is responsible for the provision of valuations for the Department of Treasury and Finance, Department of Treasury, Department of Finance, Premier and Cabinet, Major Projects Unit, Docklands and Urban Land Corporation for the State Government of Victoria. The breadth of his responsibilities include major valuation projects, including capital valuations of up to $250 million, land values for $1 billion capital development projects and office rental assessments for commercial space up to 50,000m². He was responsible for leading a team at the Valuer General Victoria in developing incentive base commercial leases - a common phenomenon of the late 80s and early 90s. He has worked through, first hand, through significant and continued change within the commercial lease market. CONTACTSimon Adcock 30 April 2001 This page is maintained by the FIG Office. Last revised on 15-03-16. |